By David Larock

Last Wednesday the Bank of Canada (BoC) announced that it would hold its policy rate steady, as was universally expected.

In its policy statement, the Bank offered an updated assessment of the state of our recovery, and, by association, indicated where our mortgage rates are likely headed over the short and medium term.

Let’s start with a quick review to explain why the BoC’s words and actions are important to anyone keeping an eye on rates.

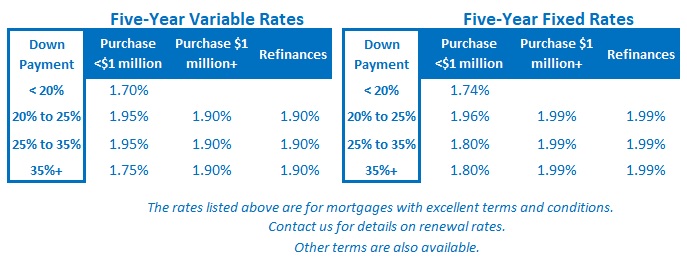

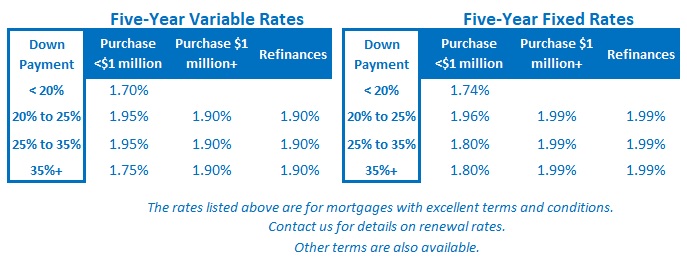

Variable mortgage rates are priced on lender prime rates, which move in lockstep with the BoC’s policy rate. So when the Bank held its policy rate steady last week, that meant that variable mortgage rates didn’t move.

Fixed mortgage rates are priced on Government of Canada bond yields. These yields are typically determined by thousands of buy-and-sell orders in the open market and normally respond only indirectly to the BoC’s policy-rate actions and commentary. But the Bank is now buying $5 billion+ of bonds each week as part of its emergency response to the pandemic, using a monetary-policy tool referred to as quantitative easing (QE), and these purchases are helping to directly suppress our bond yields, and by association, our fixed mortgage rates.

Bluntly put, the BoC’s current interventionist policies mean that its actions are effectively setting and depressing the level of most Canadian interest rates today.

Now that we have established the Bank’s dominant role in determining today’s mortgage rates, here are five highlights from its latest policy statement:

- The BoC expects that our economy’s response to the pandemic will play out in three phases: containment, reopening and recuperation.

- The initial containment phase triggered an “exceptionally severe” recession, which the Bank called “the biggest global downturn since the Great Depression.”

- The reopening stage, which we have now effectively just completed, was assessed as having been “stronger-than-expected.”

- The final recuperation stage, which we have now begun, is expected to be “slow and choppy.” The Bank doesn’t expect “the strong rebound we’ve seen to continue at the same pace in the months ahead” and instead predicts that it will “take a long time to get [our economy] back to where it was at the end of 2019, before the pandemic.”

- The Bank acknowledged that our stronger-than-expected reopening was “supported by government programs to replace incomes and subsidize wages.” But it didn’t acknowledge the recent data confirming that our federal government’s unprecedented fiscal-policy response did more than replace lost income. It raised average incomes by an average of 11% in the second quarter during “the biggest downturn since the great recession.” Whether you believe the government’s response was right or wrong, our policy makers should be more willing to acknowledge that their staggering stimulus programs did more than temporarily shield our economy from much of the pandemic’s real economic impact.

- The BoC noted that the summer brought a sharp rebound in household spending led by “stronger-than-expected goods consumption and housing activity” while employment experienced a “large but uneven rebound.” Our export sales have recovered somewhat “but are still well below pre-pandemic levels.” Most importantly, and to no one’s surprise, “business confidence and investment remain subdued.” These data were already showing weakness before the pandemic started, and with all that has happened since, it’s no wonder that businesses remain cautious.

- “CPI inflation is close to zero … and is expected to remain well below target in the near term.” The Bank’s sub-measures of core inflation are also all below 2%, “reflecting the large degree of economic slack … [with] services prices showing the weakest growth.” All of the BoC’s actions are ultimately geared toward maintaining target inflation, and the Bank is clearly more concerned about below-target inflation than above-target inflation.

- The recuperation stage “will be heavily reliant on policy support”, and everything will depend on the “the path of the COVID-19 pandemic and the evolution of social distancing measures required to contain its spread.” School reopening was also highlighted as being critically important. Basically, everything depends on whether we will see a second wave of COVID. While we’re all hoping that won’t happen, every other pandemic in history has included a second wave, so hope may be with us but the odds are not.

To summarize, the BoC believes that the next phase of our recovery will be “slow and choppy” and it plans to continue its aggressive monetary-policy interventions until the recovery is “well underway.”

More specifically, the Bank will continue on its current path until today’s “large degree of economic slack … is absorbed” and until the Bank’s 2% inflation target is “sustainably achieved”.

Translation: Ultra-low mortgage rates are going to be around for a while yet.

The Bottom Line: The BoC held its policy rate steady last week.

Its accompanying commentary confirmed both its assessment that our recovery is still in the early innings and its commitment to keep rates at their ultra-low levels until said recovery is well underway.

Against that backdrop, I expect that our fixed and variable rates will either remain at their current levels, or more likely, continue to drift lower as the recuperation stage of our recovery plays out.

Source