By: Myke Thomas

The B-20 mortgage qualifying stress test will be tweaked as of April 6 and, not surprisingly, the bureaucracy is strong in this one.

As it stands now, the stress test requires all borrowers to qualify for mortgages based on the greater of the five-year benchmark rate published by the Bank of Canada or the contractual mortgage rate from lenders, plus two percent.

On April 6, the federal finance department will introduce a new benchmark rate, which will be the weekly median five-year-fixed insured mortgage rate from mortgage insurance applications, plus two percent.

“Put simply, Canadians will be stress tested at a rate that is about two percent higher than the mortgage rate they are receiving,” says James Laird, co-founder of Ratehub.ca and president of CanWise Financial.

Sure, but the bureaucracy unsimplifies it.

The new benchmark rate will be published every Wednesday and come into effect the following Monday, so, yes, it could change every week.

The decision from the finance department covers only insured mortgages.

Pending a decision by the Office of the Superintendent of Financial Institutions (OSFI), it might include uninsured mortgages.

OSFI sets the minimum qualifying rate for uninsured mortgages. The federal finance department sets the minimum qualifying rate for insured mortgages.

OSFI is considering applying the new benchmark rate formula to uninsured mortgage applications and is seeking input from interested stakeholders on this proposal before March 17.

The bottom line?

“When you get under the covers of the new way of calculating the stress test, it ends up as a fine-tuning of the existing method. A more confusing one for sure and by our math, it increases buying power by about three percent,” says Mark Herman of Mortgage Alliance in Calgary. “It may have a slight psychological benefit as well, but neither of these are really the main issues with Calgary or Alberta home buyers right now.

“However, with the median rate changing every week, how are buyers going to be able to correctly time buying a home based on ‘this week’s median’ or ‘next week’s median.’

“It is going to cause some confusion and more likely some added stress and sleeplessness.”

And added red tape and paperwork.

The B-20 stress test was introduced two years ago specifically to cool the over-heated Toronto and Vancouver markets and Herman thinks the new tweak has the potential to add some new heat to those markets.

“For buyers in Toronto and Vancouver, it will turn a maximum $500,000 purchase into a $515,000 purchase, so again, not a big deal,” he says. “But with increasing prices in Toronto, you can bet that the added three percent of purchasing power will get added to the purchase prices right away, as buyers push as high as they can to outbid others and get into their own home.”

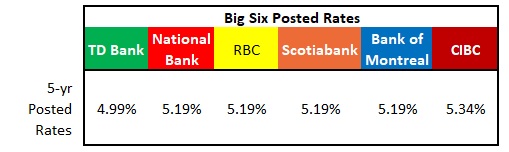

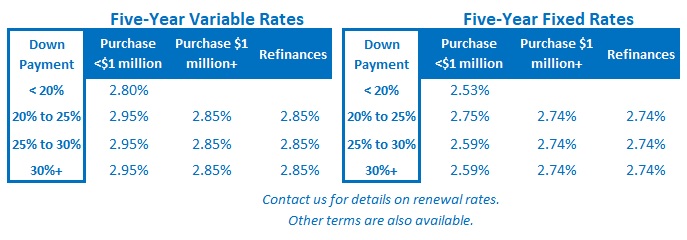

Laird expects the stress test rate will drop to about 4.89 percent by April 6, assuming current market rates.

“Canadians who are getting insured and insurable mortgages can expect to qualify for a little bit more than what they can today,” he says. “Home buyers who cannot currently qualify for what they want, but are close, should redo their qualifying calculations using the new stress test.

“According to Ratehub.ca’s mortgage affordability calculator, a family with an annual income of $100,000 with a 10 percent downpayment and five-year fixed mortgage rate of 2.89 percent, amortized over 25 years would have qualified for a home valued at $511,424 under today’s 5.19 percent qualifying rate.

“Under the new stress test rate of 4.89 percent, they (would be able to) afford $526,632.”

Obviously, any effect the tweak has will be determined by interest rates, says Colin Guldimann, an economist with RBC Economics.

“Overall, much will depend on how rates move in the near term. Our forecast calls for a rate cut by the Bank of Canada in April 2020,” says Guldimann. “Given the current low level of rates and with markets fully priced for a cut, there is limited scope for market rates to move significantly. Moving to a market-based qualifying rate will likely inject some volatility for households as market conditions pass through to the qualifying rate more quickly. While the new test may lower the bar as of April, it may make qualifying a bit more difficult if rates start to rise, as they did in 2018.”

The B-20 was often criticized by home builders, realtors and politicians for not taking into account the regional housing differences and economies in markets across Canada.

As recently as January, Phil Soper, president and CEO of Royal LePage, urged the federal government to take a regional approach to the mortgage stress test, if and when the regulations were changed.

“The stress test pushed people out of real estate markets across Canada temporarily. For the most part, buyers have adjusted, yet it still represents a significant hurdle as families pursue the dream of owning their own home,” said Soper. “We believe policy makers have the necessary experience to modify the tool to meet the reality of today’s Canada and that is, we have very different and varied economies and by extension housing policy needs, from region to region.”

Apparently, that tool was left in the box.

Tweaking B-20 is a good move. Adding regionality would make it a great move.

Source