by David Larock

Canadian mortgage rates continue to fall, and it now seems only a matter of time before they hit record lows, which I peg at about 2% for widely available five-year fixed-rate mortgages.

While the decline in mortgage rates has been hastened by the COVID crisis and the oil price crash, longer-term factors are also putting downward pressure on rates – and will continue to do so long after the current situation normalizes.

In today’s post, I’ll start by recapping how our policy makers’ actions have helped to reduce the crisis-related risk premiums that are still elevating lending spreads beyond their normal levels and inflating mortgage rates as a result. I’ll also highlight several longer-term factors that will combine to pull rates down for years to come. Then I’ll conclude by offering my take on how a declining rate outlook might guide borrowers who are looking for a new mortgage today or considering a refinance.

When COVID initially hit, yields on non-government debt surged higher as financial markets priced in crisis-related risk premiums. That pushed up mortgage rates, and then lenders raised more in a defensive move that bought them time to assess the volatile landscape.

Our policy makers responded quickly and aggressively in an effort to counteract the market’s initial reaction. For example:

- The Bank of Canada (BoC) slashed its policy rate from 1.75% to 0.25% and pledged to purchase massive amounts of federal, provincial and even corporate debt. Their main purpose was to provide liquidity, but the purchases also helped to put a lid on rates.

- The Canada Mortgage and Housing Corporation (CMHC) offered expanded access to various funding sources and pledged to purchase $150 billion worth of insured mortgages from lenders’ balance sheets (which works out to roughly 80% of the total amount outstanding).

- Our banking regulator, OSFI, reduced lenders’ capital requirements and allowed mortgages that were put into COVID-related payment-deferral programs to still be counted as performing loans.

Our policy makers pulled out all the stops, but their actions still haven’t completely counteracted the upward surge in bond yields and mortgage rates caused by those stubborn risk premiums.

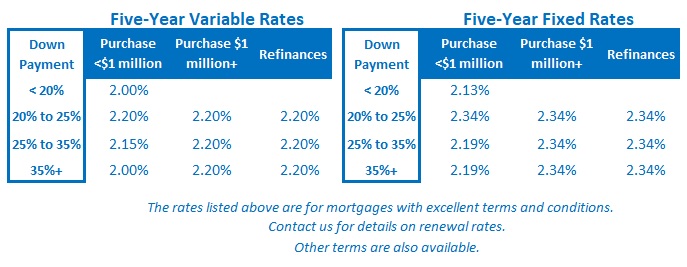

Five-year fixed rates normally hover in a range of 1.25% to 1.50% above the five-year Government of Canada (GoC) bond yields they are priced on. The five-year GoC bond yield opened at 0.38% this morning, and that would typically translate into five-year fixed rates in the 1.63% to 1.88% range. But today’s five-year fixed rates are offered in the low 2% range. There is still a risk premium evident, but on the bright side, it is now smaller than it was at its peak when the crisis hit.

Five-year variable mortgage rates normally hover in a range of 1.25% to 1.50% over the BoC’s policy rate, which today stands at 0.25%. That should put variable rates in the 1.50% to 1.75% range, but today they are priced at or around 2%. We see evidence of a risk premium there as well, although it too is waning.

Our policy makers have now recently turned to jawboning, using their words and guidance to impact market psychology.

Last week new BoC Governor Tiff Macklem conceded that even the Bank’s best-case scenarios for our recovery are “pretty bad” and that “we’re in a deep hole and it’s going to be a long way out.”

U.S. Federal Reserve Chair Jerome Powell recently offered an even more memorable quote reflecting the same sentiment when he said: “We’re not thinking about raising rates – we’re not even thinking about thinking about raising rates.”

Most economists now expect that it may well be years before we see mortgage rates rise on either side of the Canada/U.S. border, but their forecasts focus on how long it will take for our economies to recover from the current crisis, a relatively short-term issue. We shouldn’t lose sight of long-term factors that will have longer-lasting impacts on the direction of Canadian mortgage rates.

These include:

- Technological advances – We are now in a period where technological innovation is dramatically reducing the cost of almost everything. Consider that today Amazon employs more robots than people. These innovations are turning industries on their heads, and the pace of change is accelerating, as is the downward pressure on prices. Lower prices mean less inflation, and less inflation means lower mortgage rates.

- Demographics – Like most of the developed world, our country’s average age is rising. Today, we have more seniors (aged 65+) than children, and the number of seniors is rising rapidly while the number of children is declining. Retirees spend less (which lowers overall demand) and they save more (which increases the availability of capital for lending). Lower demand and increased saving will exert downward pressure on mortgage rates for years to come.

- Debt – Debt is like an invasive garden weed that crowds out an economy’s access to the resources it needs for healthy growth. When those resources are choked off, both supply and demand are limited, and inflationary pressures are less likely to take hold. At the same time, high debt levels magnify the economic impact of rate increases, which means rates don’t have to rise by as much to slow growth and relieve inflationary pressures.

If you’re in the market for a mortgage today, here is my take on how the forecast above might guide your decision-making process:

- The risk premiums that pushed mortgage rates higher at the start of the current crisis are waning but are not yet gone.

- We don’t know when, or even if, those risk premiums will fully dissipate, but at some point they should. If that happens, and/or the long-term forces listed above continue to exert downward pressure on our mortgage rates as expected, they will likely reach record lows.

- If you need a mortgage soon, the key objective is to maintain flexibility so you can take advantage of lower rates if they continue to fall.

- The best ways to do that are either with a variable-rate mortgage, or with a fixed-rate mortgage that isn’t encumbered with exorbitant penalties.

Of those two options, both of which achieve the objective, I think variable-rate mortgages will prove to be the better choice for most borrowers for three reasons (which I wrote about in more detail here):

- Today’s variable rates are lower than their fixed-rate equivalents and don’t appear likely to rise any time soon.

- Variable rates come with a free option to convert to a fixed rate at any time. If fixed rates fall as expected, you may be able to convert down to a lower fixed rate.

- The penalty to break most variable rates is only three months’ interest (whereas fixed-rate penalties are calculated using the greater of three months interest or the potentially expensive interest-rate differential penalty).

I will close this post by reminding readers that while I think it is now pretty much inevitable that record low mortgage rates are on the way, this is a forecast, not a guarantee.

As Yogi Berra once said, “It’s tough to make predictions, especially about the future.”